fulton county ga vehicle sales tax

On Tuesday August 2 City of Fulton residents have an opportunity to vote on continuing a vehicle sales tax on motor vehicles trailers boats and outboard motors purchased from outside the state of Missouri. Get a Vehicle Out of Impound.

Fulton Giving Property Owners Until Aug 5 To Appeal Tax Assessments Neighbornewsonline Com Suburban Atlanta S Local Mdjonline Com

The kiosks are prominently located inside these high volume locations.

. Tax refund after lien sale Read More Contact Us 141 Pryor St. Back Property and Vehicles. The Georgia state sales tax rate is currently.

The taxes are replaced by a one-time tax that is imposed on the fair market value of the. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. Sales Tax Rates - General General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB General Rate Chart - Effective January 1.

The Fulton County sales tax rate is. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Please type the text you see in the image into the text box and submit.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. TAVT is a one-time tax that is paid at the time the vehicle is titled. The Fulton County Sales Tax is 3.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Tax Sales - Bidder Registration. In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees.

Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner. For TDDTTY or Georgia Relay Access. Taxpayer Refund Request Form.

This is the total of state and county sales tax rates. The Georgia state sales tax rate is currently. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

The 2018 United States Supreme Court decision in South Dakota v. Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes. Get a Vehicle Out of Impound.

There is also a local tax of between 2 and 3. Kiosks will allow taxpayers to renew their vehicle registrations 24 hours a day 7 days a week. All taxes on the parcel in question must be paid in full prior to making a refund request.

SW Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. GA 30305 Kroger 800 Glenwood Avenue SE Atlanta GA 30316 Kroger 725 Ponce De Leon Ave NE. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale.

Has impacted many state nexus laws and. SUT-2017-01 New Local Taxes 13182 KB. Tax Lien Sale Refunds.

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. Registration renewals at the kiosks have no additional charges for Fulton County residents. You can find these fees further down on the page.

Present your photo ID when you arrive to receive your bidder ID card. A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state.

It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. This is the total of state and county sales tax rates. Infrastructure For All.

Customer Service Center at Maxwell Road 11575 Maxwell Road Alpharetta GA 30009. The tax rate for the first 500000 of a motor vehicle sale is 9 because all local taxes apply. Bidder ID cards will not be issued after the tax sale is under way The information entered in the following application will be used to.

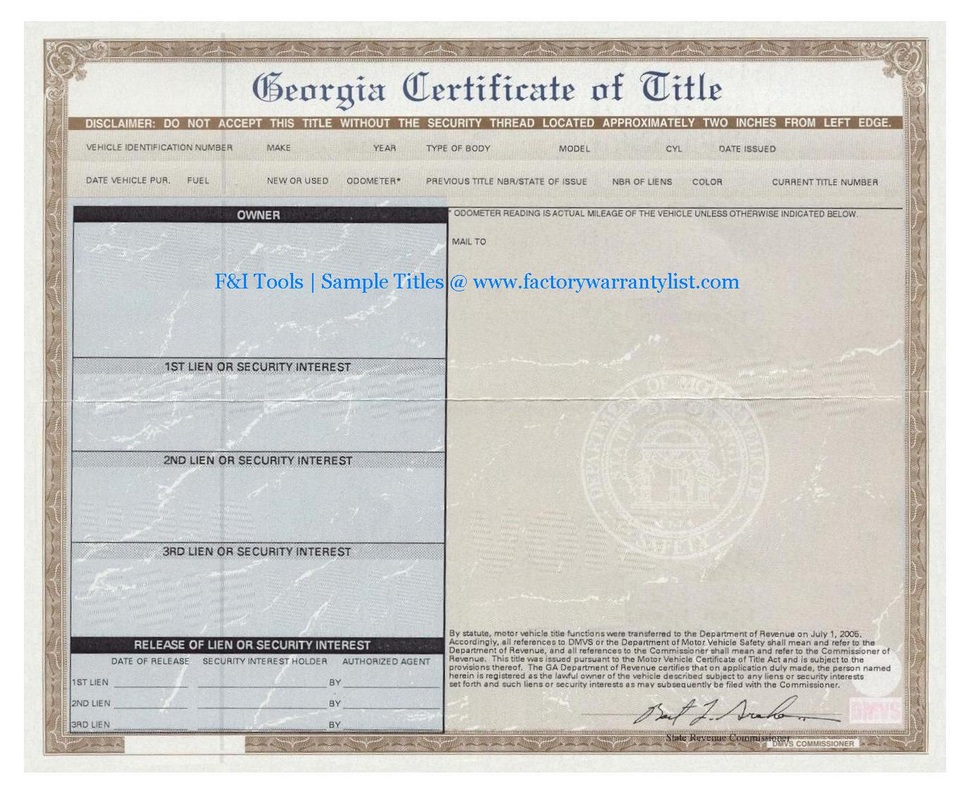

If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and registering motor vehicle equipment as mandated by law. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax.

Fulton County Initiatives Fulton County Initiatives. The Fulton County Sheriffs Office month of November 2019 tax sales. GA 30303 404-612-4000 customerservicefultoncountygagov.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 8 because the 1 regional TSPLOST does not apply. GA 30303 404-612-4000 customerservicefultoncountygagov. The Fulton County Sales Tax is 26.

Georgia collects a 4 state sales tax rate on the purchase of all vehicles. The sales tax also. The City of Fulton has depended on the vehicle sales tax averaging between 40000 and 120000 each year to fund city projects.

Please fully complete this form. GA 30303 404-612-4000 customerservicefultoncountygagov. Title Ad Valorem Tax TAVT became effective on March 1 2013.

OFfice of the Tax Commissioner.

Tax Commissioner S Office Cherokee County Georgia

Ga Georgia On My Mind Fulton County Atlanta License Plate 65283qf 71 Ebay

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Fulton Tag Offices Reopen To Long Lines Outside

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Georgia Driver S License And Tag Offices Closed Statewide Dec 30 To Jan 3

Georgia Used Car Sales Tax Fees

Fulton County Tax Commissioner Office Greenbriar Mall

What Is The Sales Tax Rate In Richmond County Ga Cubetoronto Com

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Fulton County Ga Restaurants And Food Businesses For Sale Bizbuysell

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More