salt tax deduction calculator

If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

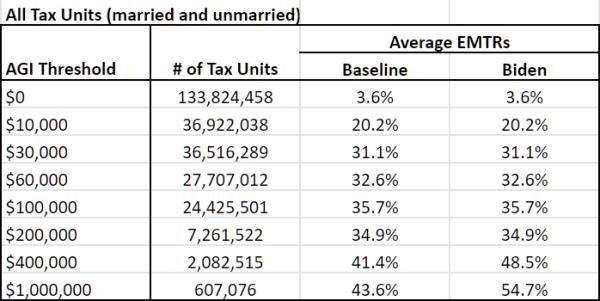

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017.

. Starting with the 2018 tax year the maximum SALT deduction available was 10000. Add up lines 5a 5b and 5c. Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth.

The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their deductions. If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025. Jeff will be able to deduct 5775 3000 2500 275 on Schedule A.

The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax rates including a reduction in the top rate. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. According to CNBC the proposed spending package would.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. New limits for SALT tax write off. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction. Repealing the SALT deduction cap and raising the top tax rate to 396 percent would reduce federal revenue by 532 billion over the next 10 years. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect.

This is doubled for joint filers. So instead of 10000 joint filers can deduct as much as 20000. The change may be significant for filers who itemize deductions in high-tax states and.

The Supporting Americans with Lower Taxes SALT Act sponsored by US. Salt deduction calculator microsoft teams reorder contact groups 000. The federal tax reform law passed on Dec.

If your total is 10000 or less write the full amount on line 5e. Sales tax paid on new truck. Though it expires in the next few years policymakers want to raise the cap much sooner to further reduce taxable income for those in high-income states such as New York New Jersey and California.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Which includes property tax any state tax paid like for last years return and includes any state withholding from your W2s and any 1099s you have. List your state and local personal property taxes on line 5c.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. Remember that he can deduct either state and local income taxes OR sales tax not both. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

But remember that Jeffs standard deduction is 12200. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020.

Seminole county liquor laws. 6 day olympic weightlifting program. No products in the cart.

52 rows The SALT deduction is only available if you itemize your deductions. The current SALT deduction cap remains at 10000 under the Tax Cuts and Jobs Act of 2017. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

This includes the SALT deduction. Lucky supermarket calgary weekly flyer. Sales Tax Deduction Calculator.

And any taxes in W2 box 14 and 19 like SDI or VDI. Annual vehicle registration fee for new truck. From 2017 and beyondincluding 2020 the maximum SALT deduction a taxpayer can claim is 10000.

SALT is State And Local Tax. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

Youll use 5000 as your threshold limit if youre married and filing separately. While the federal standard deduction nearly doubled there have been cuts and limits on certain itemized deductions. Calculators and tools associated with the links on this page will be updated during 2022 for tax year 2022 as the IRS is releasing updates.

You can only deduct up to 10000 5000 MFS for SALT State and Local Taxes. If your total is more than 10000 write 10000 on line 5e. The SALT deduction applies to property sales or income taxes already paid to state and local governments.

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. The taxes that can be.

Tax Calculator And Estimator For Taxes In 2025

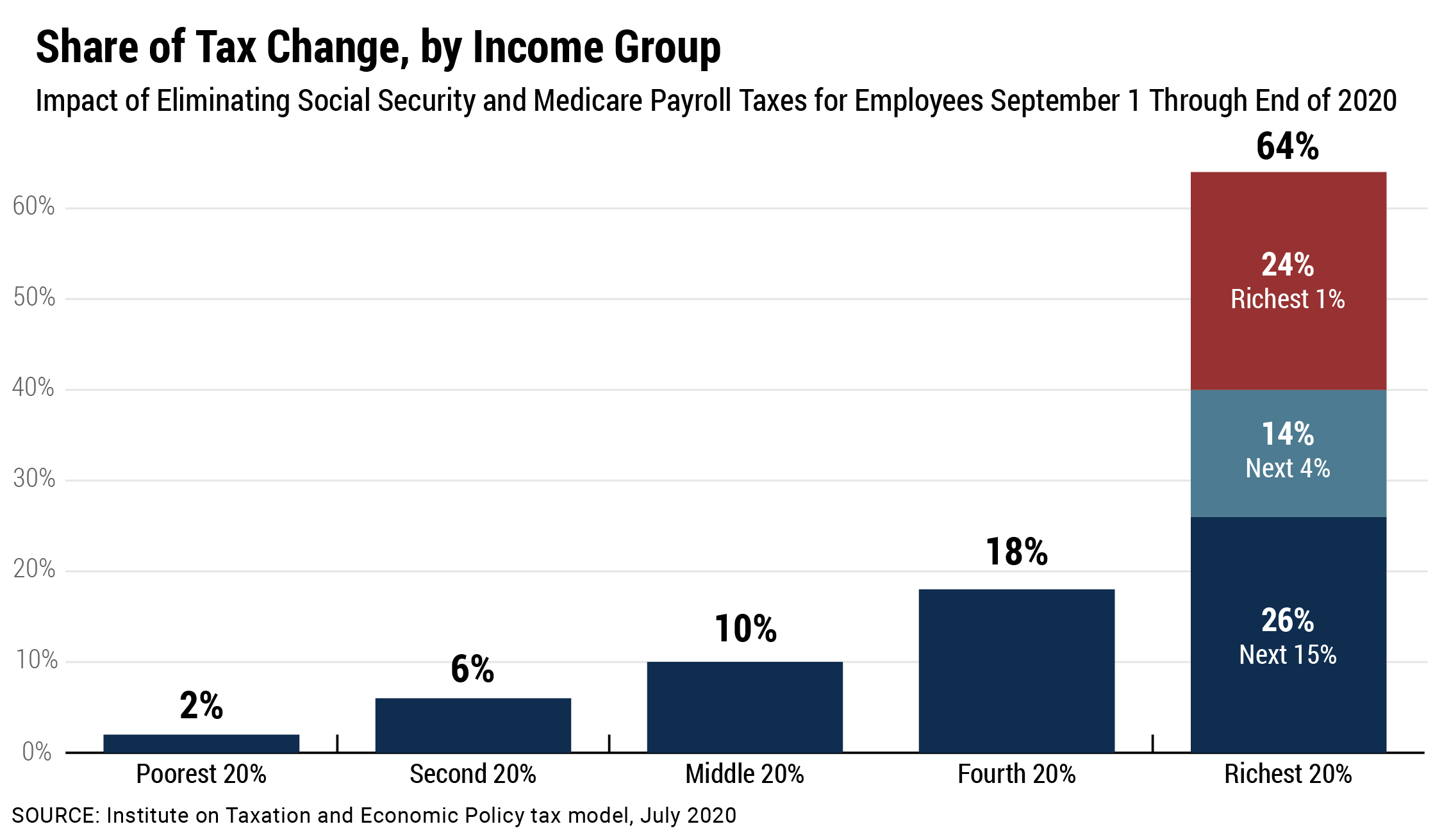

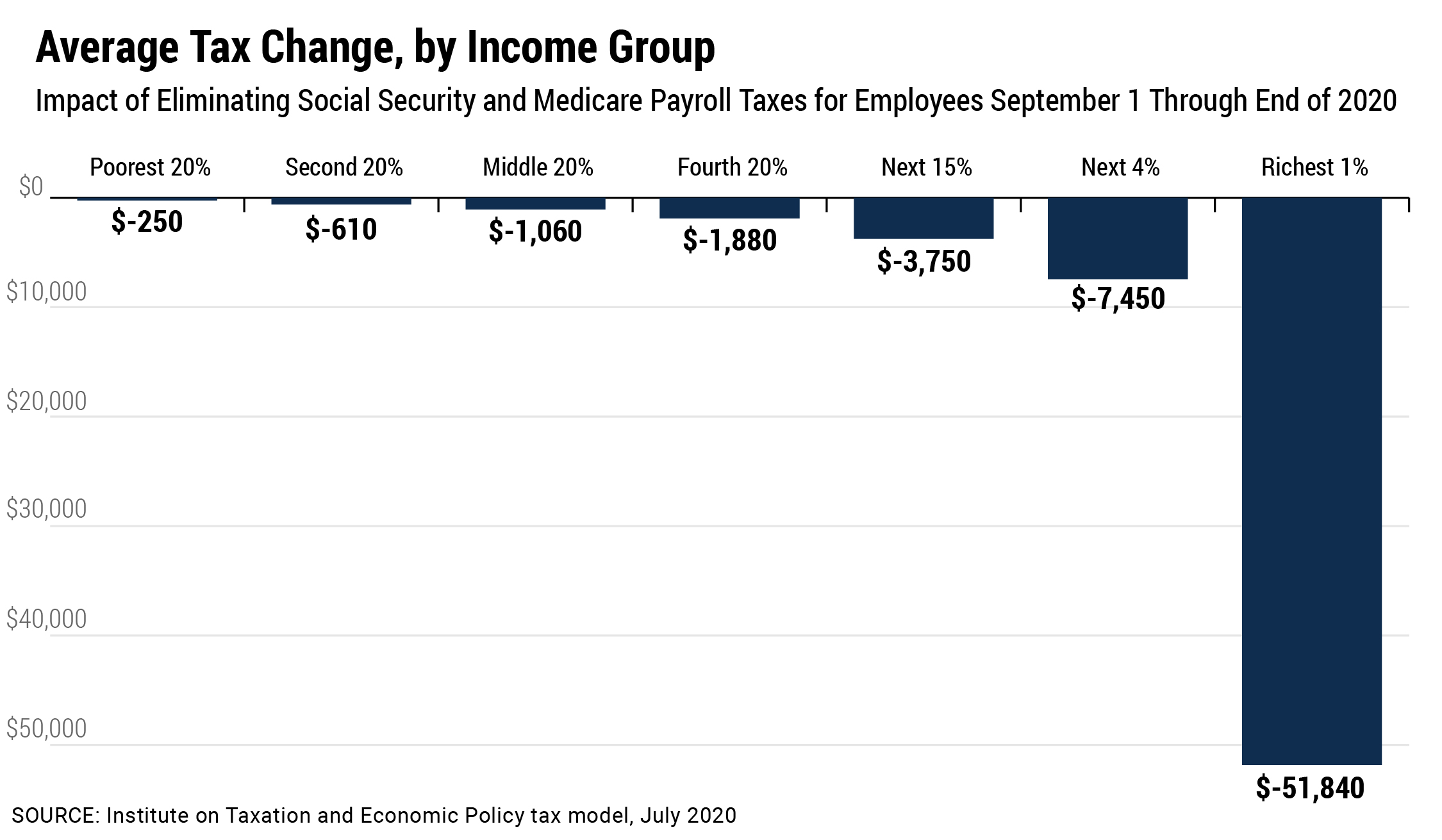

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Why Is There An Irc Section 163 J Note On My K 1 Aprio

Top 10 Salt Stories Of 2021 Grant Thornton

Trump S Proposed Payroll Tax Elimination Itep

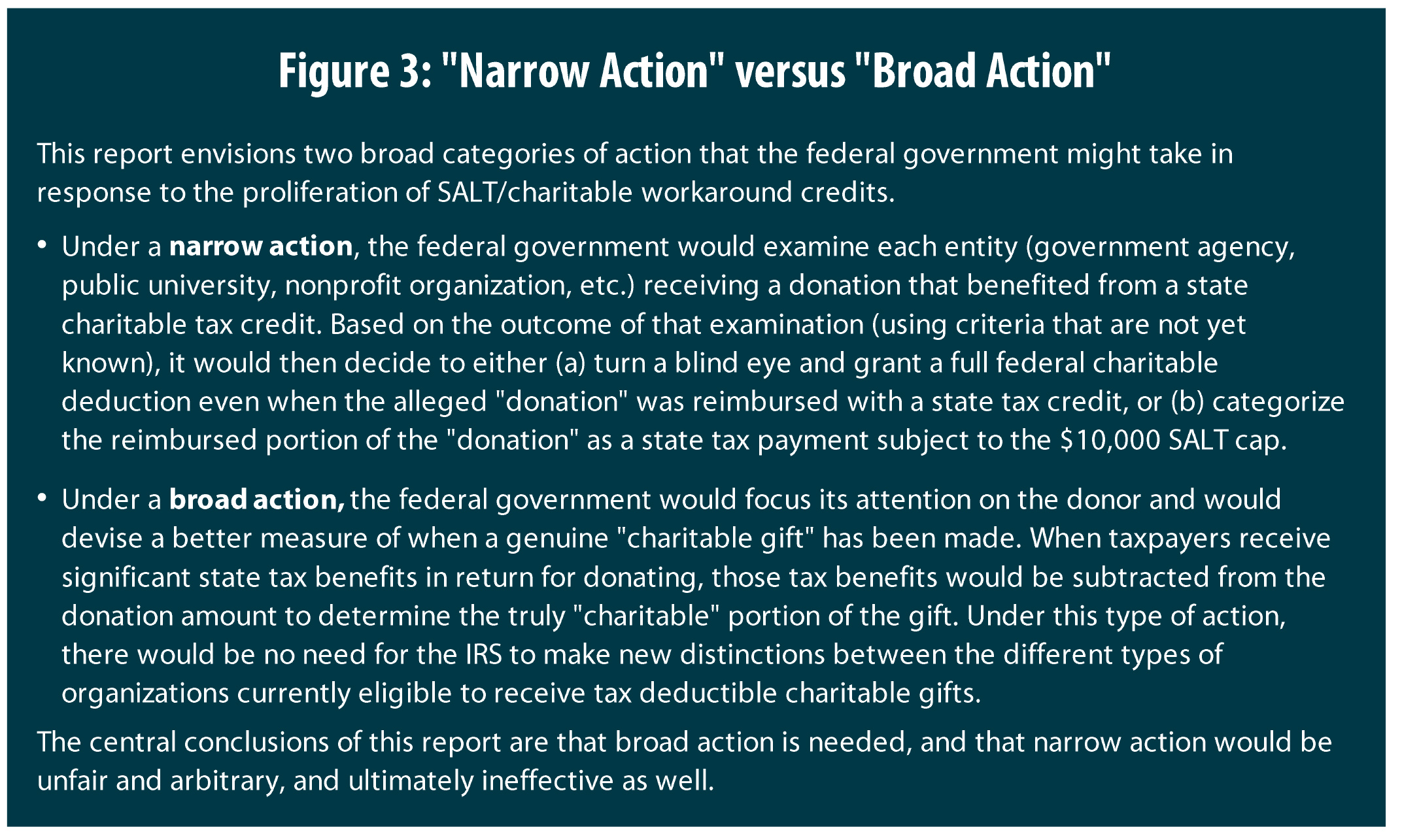

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

The Tax Cuts And Jobs Act What Does It Mean For Medical Residents

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

What Is Sales Tax A Complete Guide Taxjar

Income Tax Archives Hayashi Wayland

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

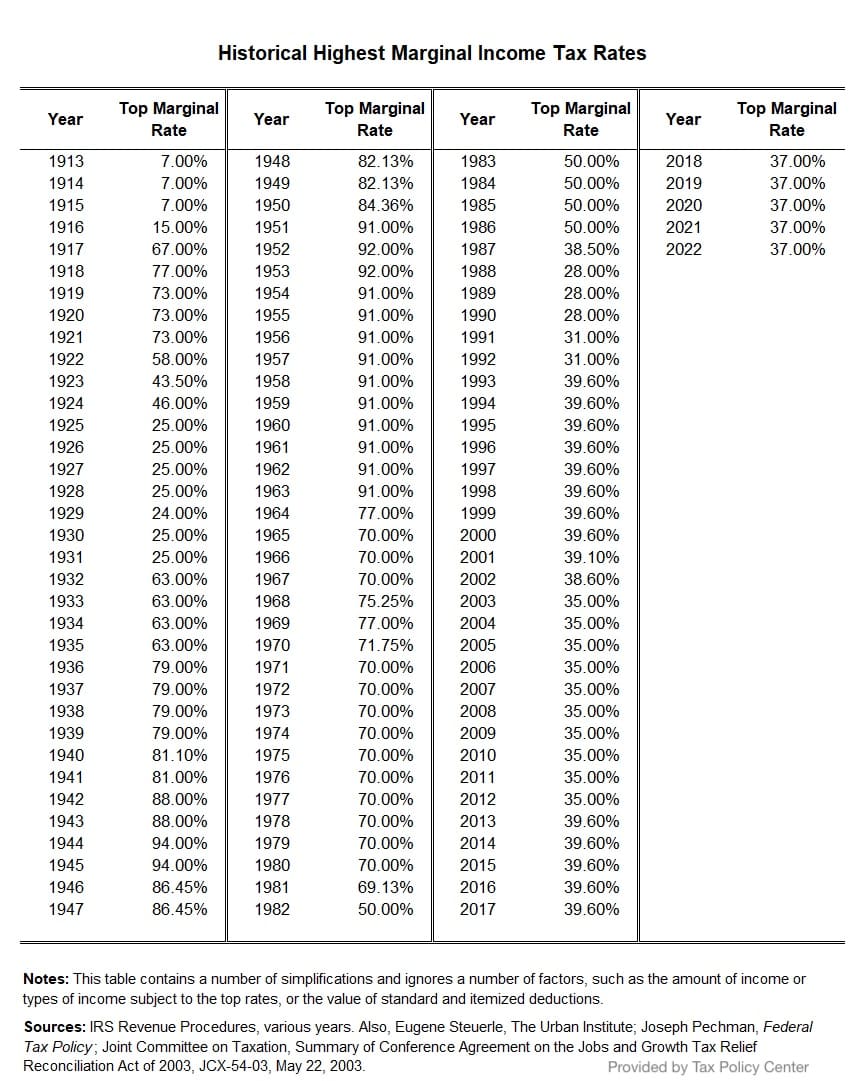

Income Tax History Tax Code And Definitions United States

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

How Property Taxes Are Calculated